Total percentage of taxes taken out of paycheck

Divide the sum of all taxes by your gross pay. File Schedule SE with your Form 1040 or 1040-SR for the year in which you go out of business.

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Lets say you make 60000 and get paid 26 times per year.

. Establishing a personal budget that sets aside 10 of your gross income every paycheck is a way of prioritizing savings. Overview of Georgia Taxes Georgia has a progressive income tax system with six tax brackets that range from 100 up to 575. This includes federal income taxes which the IRS puts toward your annual income taxes and FICA taxes which fund Social Security and Medicare.

If you earn 2000week your annual income is calculated by taking 2000 x 52 weeks for a total salary of 104000. Use the formula sum6000026 to get a bi-weekly paycheck amount of. The more taxes are taken out of your paycheck as a.

If your take-home pay after taxes is 1725 multiply that by 26 using the formula sum172526. For an asset and before the end of the assets recovery period the percentage of business use drops to 50 or less you must recapture part of the section 179 deduction. For example lets say your employer-sponsored health insurance costs 250 each month and you earn 4500 each month.

Take these steps to determine how much tax is taken out of a paycheck. When you get paid your employer takes out income taxes from your paycheck. The taxes are calculated based on how your employer pays you normally.

These steps will leave you with the percentage of taxes deducted from your paycheck. For example if your bonus or commission is included in your regular pay then its taxed according to normal federal and state withholding. A retirement account is one of the places you can put this saved money but it.

For Delaware residents it also includes state income taxes as well as local taxes for people who live or work in Wilmington. However they are not typically considered pretax so theyre taken out of your paycheck based on the amount you make before the money is taxed. If you receive it outside your regular paycheck then it becomes supplemental and your commission is taxed at a rate of 25.

That 250 would be pulled for your insurance payment and youd pay taxes. Gross income is your total income from all sources eg paychecks tips investments and bonuses before any taxes and expenses are taken out. Paycheck Protection Program PPP safe harbor.

Your gross pay consists of the total amount of money your employer pays you -- typically expressed as either an annual salary or hourly wage. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Personal Income Tax Brackets Ontario 2021 Md Tax

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

Ontario Tax Brackets 2021

Saltmoney Org Scholarship Infographic Https Www Saltmoney Org Content Media Infographic Are Schol Scholarships For College Scholarships School Scholarship

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

2021 2022 Income Tax Calculator Canada Wowa Ca

1

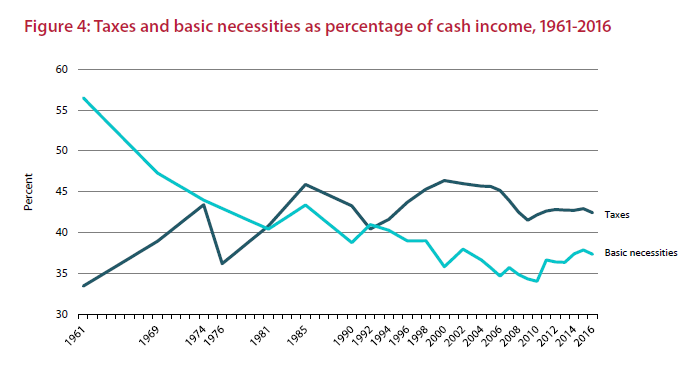

Average Canadians Pay 42 5 Per Cent Of Their Income In Taxes Report National Globalnews Ca

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

1

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Avanti Income Tax Calculator

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

3

Average Canadians Pay 42 5 Per Cent Of Their Income In Taxes Report National Globalnews Ca